Cloudian Sees $94M for Object Funding

One of Cloudian’s customers has 80 petabytes data under management on Cloudian’s object storage software, which would qualify as “big data” in most people’s dictionaries. Now the San Mateo, California company has another big number to share: $94 million, the amount of its latest funding round.

Cloudian CMO Jon Toor says the bulk of that money will go to bolster Cloudian’s business in the field. “About two-thirds of it will go into the field and sale and marketing, and about one third of it goes into engineering,” Toor tells Datanami.

Toor is quite bullish on the prospects of object storage, and today’s news suggests his backers are too. In fact, there was so much demand for a piece of Cloudian that the company had to alert journalists yesterday that the round increased by $9 million at the last minute. Even at “just” $85 million, it would have qualified as the largest ever funding round in the object storage business, Toor says.

“What’s happening now is people are recognizing the space is evolving into something that’s mainstream for the enterprise,” he says. “If you go back to our last funding round, we had one third of the customers and less than half the employees we do now.”

The company also changed its business strategy in a major way. Back in early 2017, the company was primarily selling its S3-compatible object storage system to companies that offered their own S3 storage services. Now Cloudian is selling directly into the enterprise, including healthcare companies, media and entertainment firms, security and surveillance, and biotech firms. There are even a pair of Formula 1 racing teams among Cloudian’s 240 or so customers.

Toor says the funding will help Cloudian address the needs of enterprise customers, which typically have large object storage deployments that require a fair amount of professional services along with it. “That’s what this funding is intended to help accelerate,” he says.

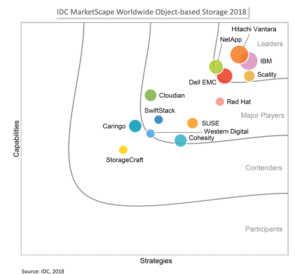

Cloudian was not listed as a leader in the latest IDC MarketScape report on object stores. IBM, Dell EMC, NetApp, Scality, and Hitachi Vantara all came out ahead of Cloudian. But with the strong momentum that Cloudian has achieved recently — not to mention the $94 million in the bank – it would be foolish to count Cloudian out of the game, especially at this early stage.

Toor says Cloudian’s flagship offering, dubbed HyperStore, has several architectural advantages over its competitors. They relate to the product’s S3 API, the choice of hardware or software, and its geo-distribution capabilities, according to the CEO.

“We think we’ve got strong advantage for S3 interoperability, because it’s the only API we’ve ever supported and nobody else can say that,” he says. “Everybody else started on something else and added S3 later on, which creates a translation layer. So we have better S3 interoperability from the start.”

The CMO also says that Cloudian is the only object storage vendor offering a “true choice” of deploying software defined storage or an appliance. “When you deploy Cloudian, you have a choice of either running it as software as your own server, or running it as an appliance that we supply. Nobody else offers that level of choice.”

The explanation behind the geo-distribution is a bit complex. Toor says HyperStore supports only one type of node, whereas other object stores have different types of node, such as one for storing metadata, one for serving API requests, and one for storing data. Cloudian nodes are deployed in groups as part of a “fully peer-to-peer network,” he says.

“The beauty about what we do is those groups can be deployed anywhere,” he says. “So you can have five Cloudian nodes sitting in San Diego County and five sitting in San Mateo and five sitting in Austin, and they all work together as one large cluster. And you can store and retrieve data to any of those nodes – just like the entire cluster was sitting in your office, but in fact all that data is spread out across the cluster.”

That has implications when the datasets get really big and geographically dispersed, Toor says. “That gives us a lot of flexibility in how you deploy it,” he says. “I can deploy it on a small server in an office, and back at the data center, I can have bigger hardware that’s more full featured and offers more capacity. It opens up doors for how you create this geo-distribution.”

Cloudian is hoping to cash in on the repatriation of applications from clouds back into the data center. Toor cited an IDC survey that found 80% of companies had moved applications from the cloud back into their own data center. “Well, those are perfect candidates for object storage because obviously they were in the cloud at one point,” he says. “Bringing those back into the data center just makes sense.”

Now that the object storage community has settled on Amazon’s S3 as the standard data format, it makes life a lot easier for companies like Cloudian. As Toor sees it, object storage is set to bust out of its “niche” status and have a bigger role storing every piece of data that doesn’t require very fast response time.

“Basically everything that’s not being used in a database is a candidate for object storage,” he says. “We’re not excelling at latency. You’re not going to use us for anything with the need for millisecond latencies. But that opens the door for about 80% of the data that gets touched infrequently. That’s the market we’re going after.”

Cloudian’s Series E funding round brings the company’s total funding to $173 million. The round includes participation from investors Digital Alpha, Eight Roads Ventures, Goldman Sachs, INCJ, JPIC (Japan Post Investment Corporation), NTT DOCOMO Ventures, Inc. and WS (Wilson Sonsini) Investments.

Related Items:

Cloudian Buys File Storage Pioneer

Object Storage Ecosystem Grows While Standardizing and Consolidating, IDC Says